Publication date: Dec 1, 2025

The Role of LNG in Japan’s Energy Transition and Upcoming GX-ETS Impacts

Despite the Japanese government’s recent push to significantly increase the share of renewable energy in the energy mix, Japan still relies heavily on thermal power (natural gas, coal, and oil) for about 70% of total generation. Among the fuel types, LNG stands out not only because Japan is currently the world’s second-largest LNG importer and LNG accounts for roughly 30% of the national energy mix, but also as a ‘bridging fuel’ because it emits significantly less CO2 than coal.

This stance is clear in the government’s key energy policy document, the 7th Strategic Energy Plan (SEP), which emphasizes the continued relevance of LNG. The newly elected Prime Minister, Sanae Takaichi, has also shown that she is keen to prioritise energy security and leverage nuclear and LNG, in addition to expanding the country’s renewable energy potential.

The role of JERA and diversification of LNG portfolio

The LNG market outlook indicates an upward demand for the fuel globally, while supply is also expected to expand significantly. JERA is Japan’s largest LNG importer, handling around 35 million tons annually. To ensure enough LNG supply and hedge against spike prices in the spot market, JERA will increase its long-term LNG contracted volumes by 20% by FY2030. As a result, its long-term contracted volume will stand at about 25 million tonnes in FY2024 and 30 million tonnes per year by FY2030 (excluding spot purchases) (Nikkei). Besides importing, JERA also acts as an LNG trader. Under the Ministry of Economy, Trade and Industry (METI)’s Strategic Buffer LNG (SBL) program, JERA imports emergency reserves during the peak demand period and resells them if there is no emergency. Although it has not been official, discussions are currently underway to substantially increase such reserve capacity to be prepared for any emergencies (Reuters).

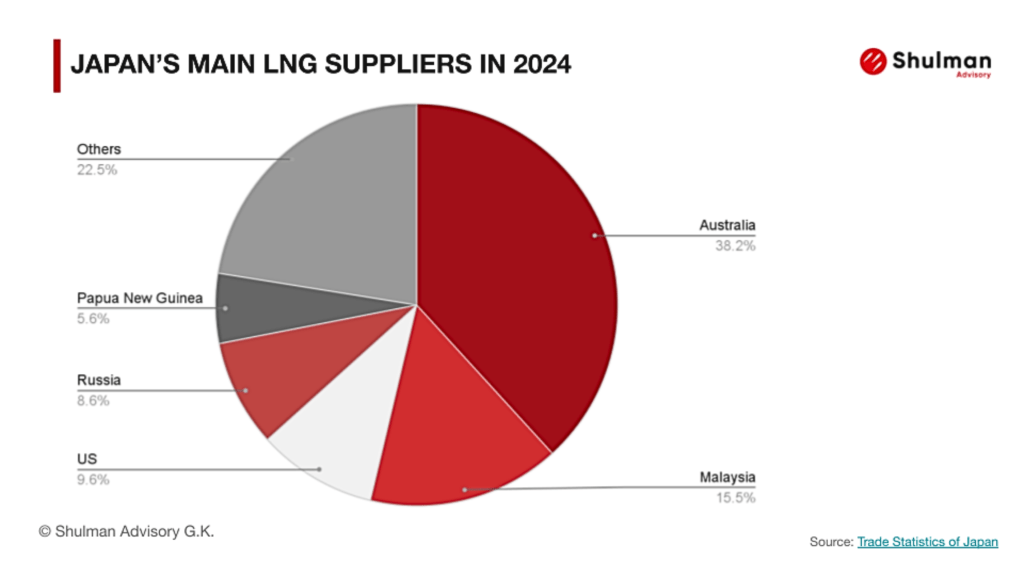

Japan imports LNG from a wide range of countries. From a total of 65.89 million tons of LNG that Japan imported in 2024, roughly half of the LNG comes from two countries: Australia and Malaysia. Other countries, such as the United States and Russia, are also among the main suppliers (see the chart). JERA recently announced it will import more LNG (around 3.5 million tons annually) from the US (Nikkei). In this way, Japan can reduce its heavy dependence on Australian LNG and mitigate any unforeseen geopolitical risks related to Russian gas, although the new Takaichi government recently noted it would continue importing gas from Russia (Nikkei).

Introduction of GX-ETS and thermal power sector

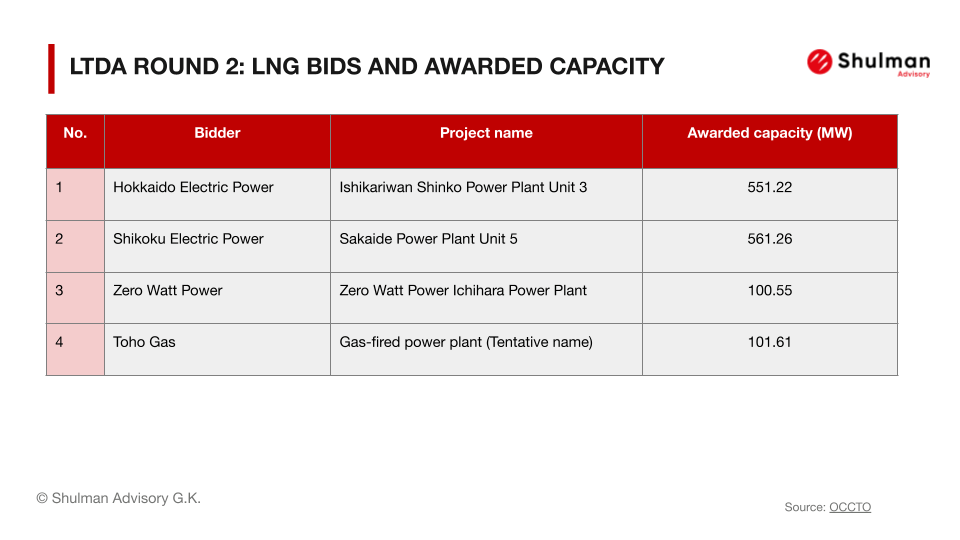

In addition to these changes in the LNG market, the thermal generation sector is facing structural challenges, as many utilities are being pressured to decarbonise their businesses under green transformation (GX) policies. The Japanese government is promoting ammonia (also hydrogen) co-firing and deployment of CCS through public financial support schemes, such as Long-Term Decarbonized Power Source Auction (LTDA), but the cost (e.g., operational, generation, and transportation) remains high and more technological advancement is needed to make it viable at scale (REI).

Following the introduction of the GX Emission Trading System (ETS) starting in April 2026, the generation cost is expected to increase for coal and gas plants, which will likely mean rising costs for end consumers. However, benchmark enforcement will be gradual. For the first three years, starting in FY2026, benchmark levels will be determined by fuel type, such as coal and natural gas. However, from FY2033 onwards, all power generators, regardless of fuel type, will be required to purchase emission allowances based on their emission levels, which could have a significant impact on business operations.

Despite the challenges, thermal plants will likely continue to play a crucial role as a stable baseload energy source. For some offtakers, such as rapidly growing data center businesses (Nikkei), a steady power supply is a non-negotiable. Among thermal plants, considering the carbon footprints and the introduction of the ETS, LNG plants have an advantage over coal-fired plants. This means that improving the economic and environmental performance of LNG plants still presents a window of opportunity.

Thank you for reading.

If you’ve enjoyed this content, subscribe to our complimentary monthly newsletter. Get updates delivered straight to your inbox every month and stay informed about our latest offerings.

Sign up here today.