Publication date: Nov 3, 2025

Japanese Government’s Growing Leadership Role in the Offshore Wind Market

Offshore wind power in Japan made headlines this summer when Mitsubishi Corporation announced its withdrawal from 1.7 GW of projects awarded in the first offshore wind auction held in 2021. Although the exit by Japan’s largest trading house left a significant impact, the government’s basic stance remains unchanged with the 7th Strategic Energy Plan, which designated offshore wind as the game changer for decarbonization, targeting 10 GW installation in general sea areas by 2030 and 30-45 GW of project formation including floating offshore wind by 2040, as part of achieving an energy mix of 40-50% from renewable energy. In line with these goals, the government in August revised its Offshore Wind Industry Vision to include floating projects within the EEZ by 2040.

Until now, offshore wind development in Japan has been largely led by private developers, who managed every stage from marine surveys and local coordination to grid access and project planning. However, recent challenges have exposed the limitations of this approach and brought to light the need for stronger government involvement in early-stage coordination, site preparation, and grid infrastructure planning, to de-risk projects and accelerate deployment.

Progress in Offshore Wind Zone Designations and Centralized Survey Initiatives

METI recently announced new offshore wind zone designations under the Act on Promoting the Utilization of Sea Areas. On October 3rd, METI designated new promising zones, a precursor to promotion zones that will be auctioned, off Akita City and Hibikinada, Fukuoka, while adding sites in Chiba, Nagasaki, and Kagoshima as early-stage preparation zones.

At the same time, sites in Akita, Chiba, and Fukuoka were selected for centralized surveys by Japan Organization for Metals and Energy Security (JOGMEC), a government R&D agency for natural resources and energy security. Under a centralized framework, JOGMEC conducts marine surveys on behalf of all potential developers, replacing the previous system where each developer conducted site surveys at their own expense. This government-led approach reduces work duplication, lowers entry barriers, and provides standardized data to all auction participants, ultimately accelerating project formation by reducing upfront capital requirements and financial risks for developers.

Expected Regulation Changes for Round 4

The next auction will be round 4, scheduled for announcement toward the end of 2025, and will be the first auction since the global offshore wind downturn and Mitsubishi’s withdrawal. It will be the government’s first opportunity to demonstrate lessons learned, with the expected main revisions including:

- Price criteria revision: Previously, a “zero-premium level” bid at the base price pressured others to match or else they would face significant point gaps. The new “quasi-zero premium level” will allow a wider acceptable price range rather than a single threshold, enabling bidders to receive competitive scores while factoring in reasonable profit margins.

- Project implementation capability scoring: Financial planning and risk management will now receive greater weight. The speed of implementation evaluation, allocated 20 points, has been revised, whereby even if an early operation date is proposed, scores will be significantly reduced or even eliminated if project feasibility and risk management are inadequate.

- Price adjustment scheme: To address cost escalation risks, the scheme allows operators to add up to 40% of unexpected construction cost increases beyond operators’ control to the FIP price. This will apply conditionally to the past auction winners to prevent withdrawals from their ongoing projects.

- Occupancy period extension: If requested, the current 30-year sea area occupancy may be extended beyond 30 years, which would increase revenue predictability and mitigate operator risks.

The Grid Reality

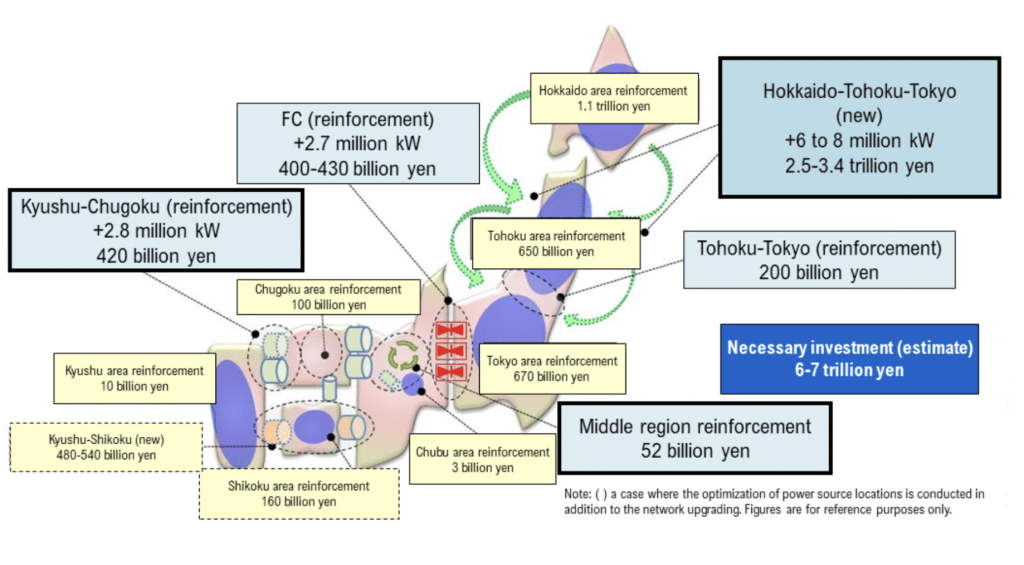

As the government advances offshore wind plans, strengthening transmission networks remains a major challenge due to limited grid capacity in the Hokkaido and Tohoku areas, where many offshore wind projects are planned, and the high cost of long-distance submarine cables that will be needed to connect these areas to the demand center in Tokyo. OCCTO’s master plan published in 2023, outlined three new transmission lines of 4 GW from Hokkaido Tohoku-Tokyo (Sea of Japan route), 2 GW Hokkaido-Tohoku and 4 GW Tohoku-Tokyo (Pacific route).

Source: METI

The Sea of Japan route’s 2 GW Hokkaido-Tohoku section completed operator selection in February 2025. Round 2 and 3 Tohoku projects are set to complete in 2029-2030 and these lines are unlikely to be ready by then, as construction is expected to take 6-10 years. Therefore, although securing grid capacity was required to participate in the auction, most past auction winners are expected to rely on non-firm connections to bridge this timing gap.

The centralized marine survey framework now feeds into the national grid securing scheme, under which the government assesses and designates suitable offshore wind capacity in each sea area, coordinates with utilities to validate and reserve grid capacity, and creates a more transparent, reliable environment for developers. This integrated approach reduces duplication, addresses potential grid constraints at an early stage, and ensures that site designations are realistically aligned with grid availability, lowering risk and streamlining project development.

The Way Forward in Advancing Government Leadership

Looking ahead, especially as Japan expands into floating offshore wind in the EEZ, success at the current stage becomes critical. Before pursuing this even more complex and capital-intensive frontier, the government faces a fundamental question: can it restore market confidence? Round 4 will reveal whether recent policy adjustments are sufficient to attract market participants back. Given offshore wind development requires long timelines, spanning decades from planning through operation, sustained government leadership and long-term policy certainty will determine offshore wind’s role in the nation’s decarbonization strategy. Japanese Government’s Growing Leadership Role in the Offshore Wind Market

Thank you for reading.

If you’ve enjoyed this content, subscribe to our complimentary monthly newsletter. Get updates delivered straight to your inbox every month and stay informed about our latest offerings.

Sign up here today.