Publication date: Sept 11, 2025 Japan Moves to Develop Hydrogen and Ammonia Supply Chains

Japan’s Simultaneous Market: The Power Trading Shift Coming After 2028

METI’s co-optimization framework aims to reshape electricity trading dynamics and create new opportunities for international market participants.

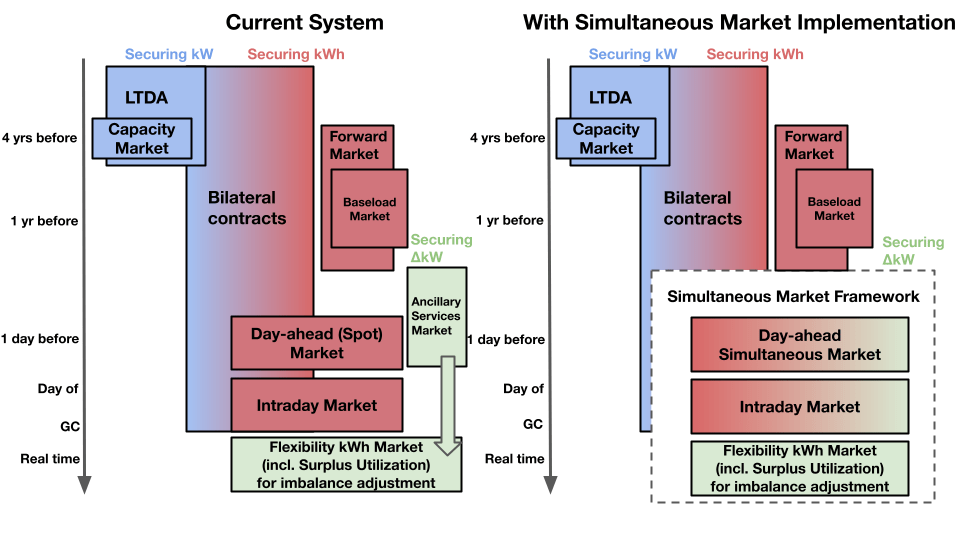

Japan’s electricity market may soon undergo one of its most significant structural transformations since deregulation. The Ministry of Economy, Trade and Industry (METI) has published detailed proposals for a “simultaneous market” (同時市場) that would fundamentally change how energy (kWh) and balancing capacity (ΔkW) are traded, creating a unified co-optimization framework similar to ISO-style markets in the United States and Australia.

Japan’s Simultaneous Market: The Power Trading Shift Coming After 2028

METI’s Rationale

Japan’s current electricity market structure suffers from what METI identifies as significant inefficiencies: chronic underbidding in balancing markets, over-reliance on the wholesale market, and increasing operational complexity as renewable energy penetration accelerates. These challenges reached a tipping point during the winter 2020-2021 supply crunch, when spot market prices soared and market liquidity evaporated.

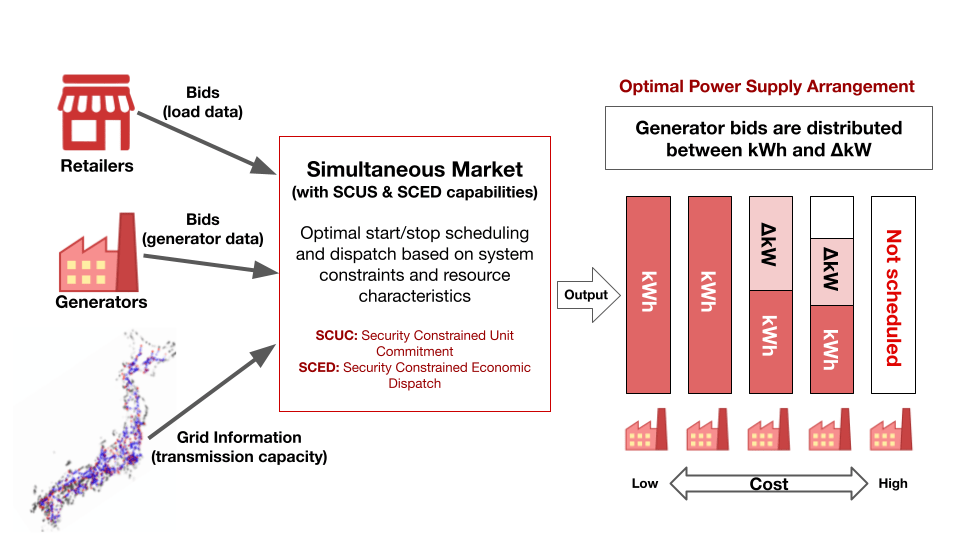

METI’s solution is ambitious: replace the current fragmented market structure with a unified system where kWh and ΔkW are simultaneously procured through a single market operator. This co-optimization approach, utilizing three-part bidding (startup costs, minimum output costs, and incremental cost curves), aims to eliminate the resource competition that drives price volatility while optimizing grid reliability and economic efficiency.

Japan’s Simultaneous Market: The Power Trading Shift Coming After 2028

Market Design and Operational Framework

Three-part bidding: Unlike Japan’s current simple energy bidding, generators will submit comprehensive cost information including startup costs, minimum output expenses, and incremental cost curves. This transparency enables system-wide optimization previously impossible under Japan’s bilateral contract-dominated structure.

Dual timeline operations: The system will operate through day-ahead simultaneous markets followed by intraday simultaneous markets, allowing continuous optimization as demand forecasts and renewable output predictions evolve closer to real-time delivery. The system will employ Security Constrained Unit Commitment (SCUC) and Security Constrained Economic Dispatch (SCED) algorithms and optimization systems to determine optimal generation dispatch while respecting transmission constraints.

Flexible resource classification: Generators can choose between “self-scheduled” resources (where they control startup decisions) and “pool-scheduled” resources (where market optimization determines dispatch). This flexibility is intended to address industry concerns about operational control while enabling system optimization.

—

Strategic Opportunities

Volatility arbitrage: METI’s analysis suggests that generators with market power may strategically lock low marginal cost assets into long-term simultaneous market transactions while reserving high marginal cost generation for spot markets. This dynamic could significantly boost spot market volatility, creating favorable conditions for battery energy storage systems and other flexible technologies that profit from price volatility.

Forward market development: The integration of energy and balancing markets will establish Japan’s first comprehensive forward curve extending beyond day-ahead timeframes. Early market participants may capture significant value from pricing inefficiencies during the transition period as market participants adapt to the new framework.

Technology advantage: The emphasis on rapid-start capabilities and flexible dispatch creates opportunities for modern, technologically advanced generation assets. International developers with experience in ISO-style markets possess valuable expertise in optimizing operations under co-optimization frameworks.

Bilateral contract innovation: While the simultaneous market centralizes optimization, bilateral contracts remain viable. Sophisticated traders can structure innovative arrangements that meet compliance requirements while capturing value from market transitions and regulatory uncertainty.

—-

Implementation Challenges and Timeline

METI’s November 2024 report reveals significant implementation complexities that will influence market development:

Timeline uncertainty: While initial discussions targeted 2028 implementation, METI now suggests the simultaneous market will launch “anytime from 2028 onwards,” with full implementation likely after 2030. This extended timeline reflects the substantial technical and regulatory challenges involved.

Industry resistance: Strong industry opposition to current proposals suggests significant modifications are likely. Cost-benefit analyses show positive results, but implementation details remain contentious, particularly regarding mandatory participation and operational control.

Technical complexity: The integration of renewable energy sources, distributed energy resources, and storage systems into the co-optimization algorithm presents unprecedented technical challenges. METI acknowledges ongoing uncertainty about how renewable output variability will be incorporated into the optimization models.

Regulatory integration: The simultaneous market must integrate with Japan’s complex web of existing markets including the capacity market, long-term energy procurement requirements, and various balancing mechanisms. This integration requires careful sequencing and potential modification of existing frameworks.

—

Market Structure

Mandatory participation: METI proposes requiring generators to bid both energy and balancing capacity in the simultaneous market, representing a shift from current voluntary participation. However, the scope and enforcement mechanisms remain under discussion.

Pricing: The new framework would establish Japan’s first comprehensive electricity price index spanning multiple time horizons and product types. This pricing transparency could fundamentally alter how power purchase agreements and risk management products are structured.

Grid constraint considerations: Unlike current markets that largely ignore transmission constraints until after trading, the simultaneous market will incorporate grid limitations directly into the optimization algorithm, potentially creating locational price differences and new hedging requirements.

—

Strategic Implications

Entry timing advantage: The extended implementation timeline and current industry uncertainty creates a strategic window for establishing market positions before regulatory frameworks solidify. Early entrants may benefit from grandfathering provisions or preferential treatment as METI seeks to attract competition.

Expertise premium: International traders with experience in ISO-style markets possess valuable operational knowledge that domestic participants currently lack. This expertise gap represents a significant competitive advantage during the transition period, despite potential language barriers.

Infrastructure investment: The simultaneous market will require substantial system upgrades and new operational capabilities. Technology-forward international participants may gain competitive advantages through early investment in compatible systems and processes.

Regulatory navigation: The complexity of integrating the simultaneous market with existing Japanese regulations creates substantial compliance challenges. Expert guidance becomes essential for avoiding costly mistakes during market entry and operational setup.

—

Critical Success Factors

Success in Japan’s evolving power market will require understanding both the technical aspects of co-optimization and the nuanced regulatory environment that shapes policy implementation. The interconnection between licensing requirements, market participation rules, and operational obligations creates multi-dimensional challenges that extend beyond simple market analysis.

For international market entrants, the simultaneous market proposal amplifies existing complexity while creating new opportunities. Those who position strategically during the extended development period may find significant advantages as the framework crystallizes.

The next phase of METI’s discussions will address critical implementation details including product design, trading mechanisms, liquidity enhancement measures, and pricing methodologies. These technical specifications will ultimately determine the practical opportunities and constraints facing market participants.

—

Looking Ahead

While implementation timelines remain uncertain and industry resistance may modify specific proposals, METI’s commitment to market integration signals a fundamental shift toward greater efficiency and renewable energy accommodation.

For sophisticated international traders, Japan’s simultaneous market evolution presents a rare opportunity to participate in designing and implementing a next-generation electricity market. The combination of regulatory complexity, technical sophistication, and market opportunity creates ideal conditions for expert advisory partnerships.

—-

Thank you for reading.

If you found this topic interesting, and would like to meet us in person to discuss these developments and learn more about our services, join us at Japan Power Week, taking place 20 – 23 October, 2025.

Shulman Advisory provides comprehensive regulatory guidance and strategic insights for international power traders and players navigating Japan’s complex electricity market evolution. Our deep understanding of METI’s policy development process enables clients to position strategically for Japan’s market transformation.