Publication date: June 3, 2025 Weathering the Storm: Weather Forecasting and Battery Energy Storage Systems in Japan’s Changing Climate

Hot Grid Summer: Forecasting and Navigating Japan’s Power Markets in Summer 2025

This article was co-produced by Shulman Advisory and Atmospheric G2. Here, we provide an outlook and preview into expected weather patterns in Japan over summer 2025 and consider the impact on power markets.

As the mercury continues to climb, we can anticipate another hot summer in Japan for 2025, following two consecutive years of record-breaking heat observed in the summers of 2023 and 2024. According to the Japan Meteorological Agency’s latest three-month nationwide weather outlook (covering June to August 2025), temperatures are likely to be “higher than the average”, and the influence of warm and moist air is expected to make precipitation levels “close to normal” or “above average” across both eastern and western Japan (JMA).

In recent years, Japan has experienced almost consecutively record-breaking summer temperatures and more intense heatwaves. One such event occurred in June 2022, when the Kanto region saw an intense heatwave that drove a sharp surge in electricity demand. As a result, the Ministry for Economy, Trade and Industry (METI) issued a power supply-demand alert in the Tokyo area, as the reserve margin was projected to fall below 5%. The sharp increase was also felt in the Japan Electric Power Exchange (JEPX) spot market, which resulted in electricity prices in the Tokyo area temporarily soaring to JPY 200 / kWh (JEPX).

–

Summer 2025 Weather Forecast

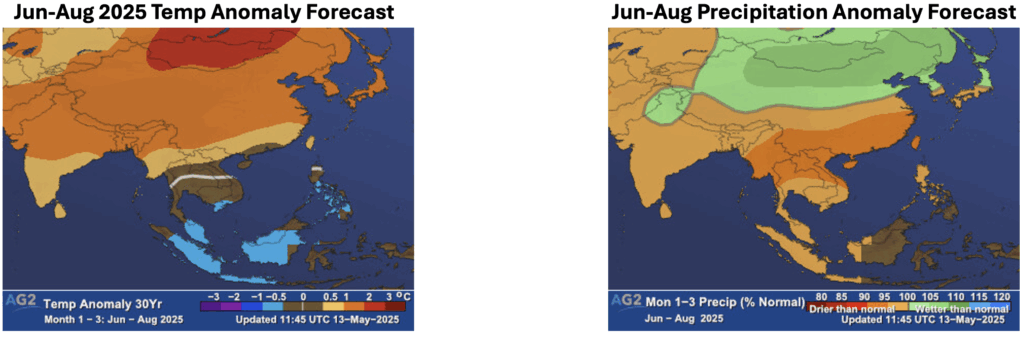

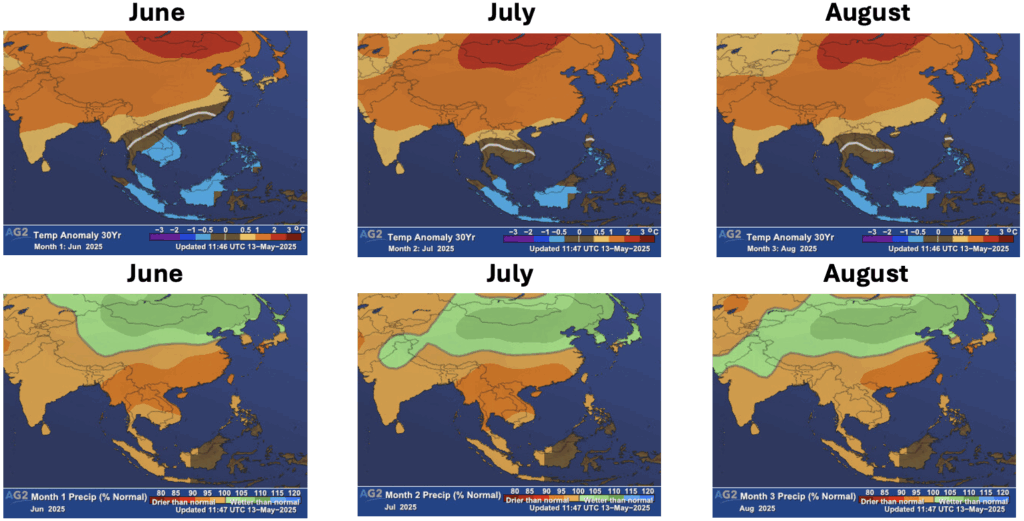

As Japan anticipates another hot summer this year, understanding the specific weather patterns expected becomes essential. Drawing from advanced climate modeling, Atmospheric G2’s summer 2025 outlook for Japan forecasts a hotter-than-normal season across all regions, supported by both the European C3S and North American NMME climate models, as well as historical ENSO (El Niño Southern Oscillation) analog years (figure 1). The Eastern grid is expected to be hotter and wetter in June, while July and August will bring widespread heat across both the Eastern and Western grids, with drier conditions particularly in the West (figure 2). ENSO is predicted to remain in a neutral phase through mid-summer, which is historically associated with modest heat and variable rainfall patterns, especially wetter Augusts.

Precipitation forecasts indicate near-normal to slightly wetter conditions across the East grid but drier conditions are expected across the West grid. Solar power generation may be challenged early in the season due to cloud cover but is expected to improve by mid-June, especially in the West grid. Wind generation is forecast to be average to below-average, while hydro resources could benefit from snowmelt and early summer rains, although typhoon activity may be lower than normal later in the season.

Figure 1. Summer 2025 temperature anomaly forecast (left) and precipitation anomaly forecast (right) across the Asia Pacific region and Japan.

—

Figure 2. Summer 2025 monthly breakdown of temperature (top row) and precipitation (bottom row) anomalies across the Asia Pacific region and Japan.

–

Historical Precedents

To understand how these forecasted conditions might impact Japan’s energy sector, it’s instructive to examine recent precedents. Japan’s summer power markets have consistently shown high sensitivity to extreme heat, with historical data revealing a clear correlation between rising temperatures and energy market stress. As heatwaves intensify, power demand, primarily from cooling, surges, putting strain on supply and driving up prices.

The 2018 heatwave serves as a defining example. That summer, Kumagaya City recorded 41.1°C, the highest temperature ever observed in Japan. In response, utilities implemented demand response measures with requests to curb consumption, while transmission system operators (TSOs) coordinated cross-regional power redistribution to stabilize the grid (IEEJ).

In summer 2024, the average temperature in Japan was 1.76°C above the normal level, tying with 2023 for the highest temperature increase from the average on record. Though early forecasts projected wide-area reserve margins in the Tokyo area to stay above 8% through August and September, actual conditions at times saw margins drop below 5%, triggering serious concerns over grid reliability (METI).

—

Supply-Side Challenges

Beyond demand pressures, extreme summer weather poses significant challenges on the supply side as well. Supply conditions are also heavily influenced by weather and infrastructure capabilities. For example, higher solar panel surface temperatures can decrease the efficiency of solar power generation, limiting the output by approximately 10%, depending on design. This reduced efficiency of the panels themselves during extreme weather could also have notable effects on standard peak demand hours, with more constraint likely to be observed in the mornings and evenings when solar power generation is lower anyway.

The role of thermal power generation is also important as a backup during the summer months, though these plants (along with nuclear facilities) experience efficiency losses because of extreme weather, excessive heat and water shortages. For nuclear facilities that are dependent on water for cooling purposes, excessive heat can increase the temperature of this cooling water, necessitating a reduction in power output.

Recognizing these supply-side vulnerabilities, power producers have turned to both infrastructure upgrades and fuel procurement strategies. As part of these efforts, some aging thermal power plants are being brought back online or replaced to bolster supply capacity (METI). However, these measures come with added complexity; securing sufficient LNG and other fossil fuels during peak summer months has become a growing challenge, especially amid global competition and market volatility (METI). The situation is further complicated by Japan’s heavy reliance on fuel imports, with LNG accounting for a significant share of summer power generation, particularly as a flexible resource to meet variable demand.

–

Strategic Market Approaches

Given these supply-side constraints and the anticipated weather patterns for summer 2025, market participants need well-calibrated strategies and timing is critical. Positions taken in late spring can offer strategic advantages, as this timing capitalizes on emerging seasonal patterns before power prices fully reflect heat-related risks. Staying responsive to shifts in forecast confidence can further enhance timing decisions. Given the volatility introduced by weather uncertainty, flexible hedging strategies, such as structured products or dynamic pricing contracts, can help limit downside exposure. These should be calibrated around seasonal climate risks, especially in years with strong El Niño or La Niña signals.

Regional price spreads may offer arbitrage opportunities, particularly in areas where supply-demand dynamics differ due to localized weather or grid constraints. Close monitoring of intra-regional pricing and transmission capacity is key. Leveraging weather forecasting services, especially those offering probabilistic or long-range insights, can inform both tactical and strategic decisions. Integrating these forecasts into planning models allows market participants to anticipate risk earlier and adjust portfolios accordingly.

Looking ahead to the coming months, the weather outlook points to higher-than-average temperatures across Japan in 2025, which will likely increase demand and result in higher power prices. As we continue to observe similar trends year-on-year, weather forecasting remains a critical tool for anticipating market conditions and identifying risk.

By using weather forecasting services to help with aligning operational and procurement strategies, market participants can enhance resilience and responsiveness towards potentially increasingly volatile conditions. We aim to provide a follow-up analysis as summer progresses, where we’ll assess how actual conditions unfold and what the implications are for the Japanese power market in summer 2025.

________________________________________________________________________________________

Thank you for reading. This report is also available as a PDF for download here.

This is the fifth article in our mini-series on harnessing weather intelligence to optimize renewable asset performance. If you missed the previous articles, you can catch up here:

- First article: Harnessing Weather Intelligence for Renewables to Optimize Asset Performance in Japan: Solar

- Second article: Understanding & Forecasting Wind Power Generation in Japan

- Third article: Understanding & Forecasting Hydroelectric Power Generation in Japan

- Fourth article: Weathering the Storm: Weather Forecasting and Battery Energy Storage Systems in Japan’s Changing Climate

The partnership between Shulman Advisory and Atmospheric G2 leverages extensive power market advisory and market leading weather forecasts. If you are interested in learning more about our services, please contact us at info@shulman-advisory.com.