Publication date: March 25, 2024

February 2024 Monthly Newsletter

Welcome to the second edition of our newsletter in 2024 on the latest happenings in Japan’s dynamic power market! We’re thrilled to bring you insightful stories shaping the energy landscape. From groundbreaking developments in decarbonization to innovative strategies for integrating electric vehicles with the power grid, there’s much to explore and discuss.

In this edition, we unravel the latest on Japan’s long-term decarbonization capacity market auctions, delve into the evolving offshore wind regulations within Japan’s Exclusive Economic Zone (EEZ), and uncover the strategic vision driving Japan’s ambition to seamlessly merge EVs with the power grid by 2030.

Long-Term Decarbonized Power Source Auction to Include Nuclear Facilities and CCS

The Agency for Natural Resources and Energy (ANRE) is discussing expanding the scope of the next long term decarbonized power source auction from as early as January 2025. This auction provides a 20-year fixed revenue for newly developed power sources, including battery energy storage systems (BESS), to promote the growth of new technology and to stabilize the electricity supply, although suppliers lose 90% of revenue from other sources.

Discussions are shifting towards considering upgraded existing nuclear power facilities and thermal power plants with Carbon Capture and Storage (CCS) in the second auction, expected in January 2025. As meeting new regulatory standards becomes imperative, investment in safety measures at existing nuclear plants is crucial. However, retrofits and voluntary measures may be permissible. Furthermore, authorities are examining potential penalties for delays in the start-up of auctioned nuclear power. Regarding CCS-equipped thermal power, the appropriate CO2 capture rates are still pending determination.

The current system incorporates fixed costs for dedicated and co-firing power generation using hydrogen and ammonia. Moreover, the scope of the long-term decarbonized power source auction may extend to covering fixed costs for overseas production of these fuels, contingent upon adequate information, such as contracts distinguishing basic and variable charges. Nevertheless, implementing this change will necessitate adjustments to accommodate the new hydrogen price difference support system.

Japan to Submit Revised Bill to Promote Offshore Wind Power Generation in the EEZ

The Japanese Cabinet Office plans to submit a revised bill for the Marine Renewable Energy Act to the regular Diet session in early March to promote the introduction of offshore wind power generation in Japan’s Exclusive Economic Zone (EEZ). The revision will include a two-step process where the Ministry of Economy, Trade and Industry (METI) will designate development areas for auction, and project developers will submit area proposals and business plans and receive a “provisional status” by the METI and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) Ministers.

The developer will then form a council consisting of experts, local fishermen, and other stakeholders to discuss issues such as the impact on the environment and the fishing industry.

Installation permits will then be granted if the developer receives consent from the council and the project proposal meets certain criteria. No further environmental assessments will be required as the Ministry of the Environment (MoE) will have conducted the investigations when deciding on the development areas.

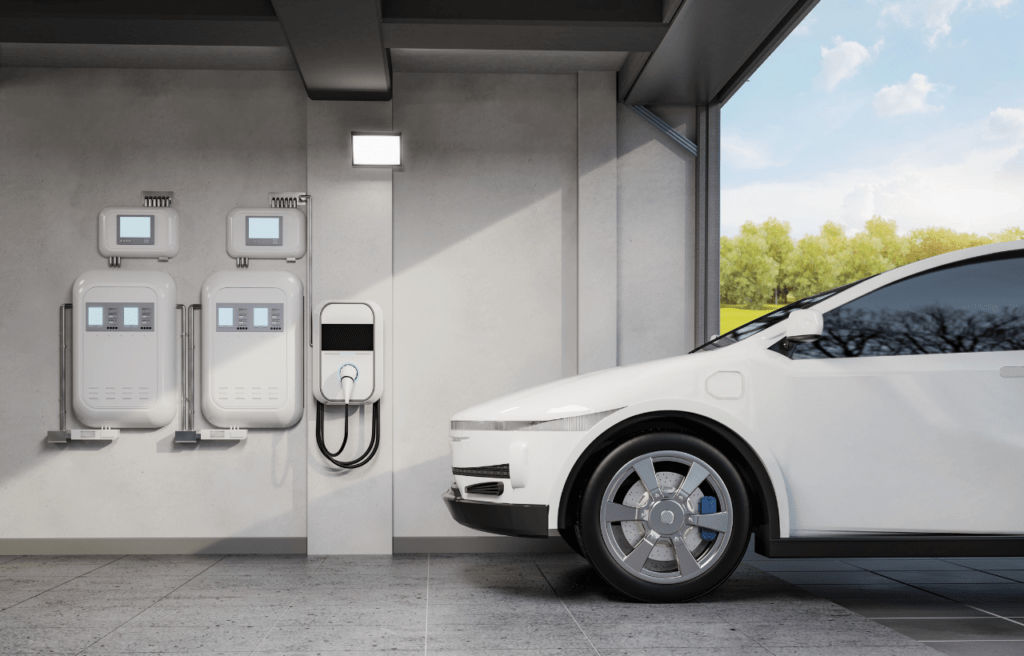

Strategic Vision for Merging EVs With the Power Grid by 2030

METI’s EV Grid Working Group unveiled a draft summary outlining a strategic vision and the challenges for merging electric vehicles (EVs) with the power grid by 2030. This blueprint proposes that electricity providers introduce pricing schemes incentivizing EV charging during off-peak, cheaper electricity hours. Furthermore, it envisions equipping every EV owner’s residence with advanced charging stations featuring connectivity capabilities. The ministry aims to refine this proposal, leveraging it to foster the adoption of distributed energy resources and shape future EV and charging infrastructure policies.

The forward-looking strategy for 2030 also encompasses setting up fast-charging stations in high-demand locations, offering cost-effective charging options utilizing excess renewable energy, and expanding service availability. It suggests a model where in-vehicle batteries serve as dependable assets within the demand-response market, aiding in alleviating peak demand and rewarding participating users.

Looking ahead to 2040, it suggests that in-vehicle batteries will play a pivotal role in the demand-response market, ensuring a stable power supply during peak consumption times.

Thank you for reading. If you’ve enjoyed this content, subscribe to our complimentary monthly newsletter delivered straight to your inbox every month and stay updated with our latest offerings. Sign up here today.