Publication date: Oct 30, 2025 METI Moves to Reshape Japan’s Balancing Market with New Price Cap Limits

METI Moves to Reshape Japan’s Balancing Market with New Price Cap Limits

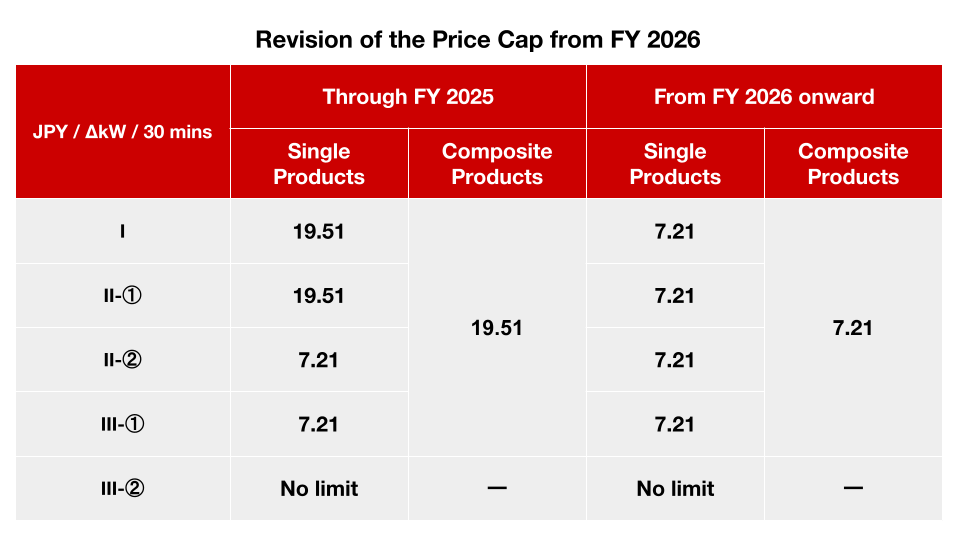

The secretariat of METI’s System Review Working Group proposed some major changes to the balancing market from FY 2026, including reducing the price cap for combined products from JPY 19.51 to JPY 7.21.

Is this cause for immediate concern? Not immediately. It seems like METI is trying to avoid a repeat of the difficulties seen two years ago, when the composite market integrating multiple balancing products opened and prices surged far beyond expectations. It will take more discussions with the industry and within the committee to implement this change. At this meeting, many participants questioned the need to lower the price cap, warning that it could complicate project financing for the many developments now underway. There was also a lack of clarity on how the price cap would hold up once products start trading day-ahead in April 2026. It could discourage participation, and withholding seems inevitable if the spot market is trading at a much higher price or if marginal costs are higher.

Have more questions about how balancing price caps might affect trading and flexibility returns? Shulman Advisory helps foreign players quantify and navigate Japan’s market reforms. Get in touch to learn more!!

Proposals made by the METI Working Group:

- A reduction of procurement volume for all products to 1σ of the required capacity. Currently, I and II-① are capped at 1σ of the required capacity, while II-② and III-① is capped at 1σ, unless the wide-area reserve margin on the previous day falls below 12%, and then it is raised to 3σ.

- Lowering the cap price for all products, excluding III-② to JPY 7.21 / ΔkW / 30 mins (see table below)

- EPRX should be allowed to revise transaction fees during the fiscal year.

Transaction fees are currently set at JPY 0.03 / ΔkW / 30 mins and reviewed once annually, but mid-year adjustments should be made possible given the growing difficulty of keeping costs and revenues balanced amid fluctuating procurement volumes, mid-year adjustments to reduction coefficients, and ongoing system modifications.

–

Other Notes:

- From April 2026, products I, II-①, III-① will join III-② to be day-ahead procurement, replacing the current week-ahead procurement.

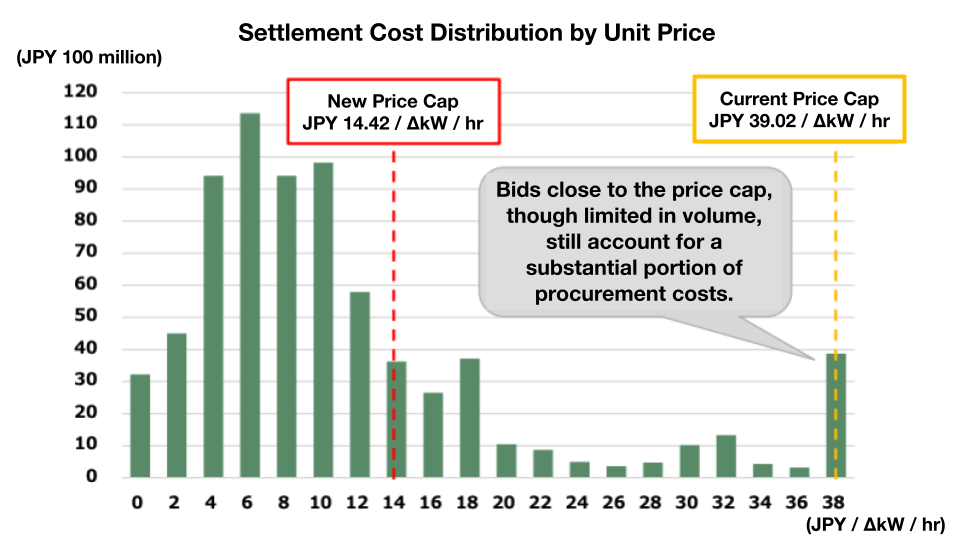

- METI is concerned that bids settled near the current cap price are raising settlement costs and impacting the total procurement cost.

___________________________________________________________________________________