Publication date: Sept 11, 2025 Japan Moves to Develop Hydrogen and Ammonia Supply Chains

Japan’s Power Market Revolution: METI’s Bold Plan to Secure Demand Three Years Ahead

How new mandatory procurement rules could reshape trading opportunities and market dynamics.

Japan’s Ministry of Economy, Trade and Industry (METI) is proposing a fundamental shift in how electricity retailers secure their supply. The proposal centers on a new requirement that would mandate retailers to secure 50% of their projected demand three years in advance, rising to 70% one year ahead of delivery.

For international power traders and potential market entrants, this regulatory development represents both unprecedented opportunity and complexity that demands expert navigation.J

Japan’s Power Market Revolution: METI’s Bold Plan to Secure Demand Three Years Ahead

The Driving Forces Behind METI’s Proposal

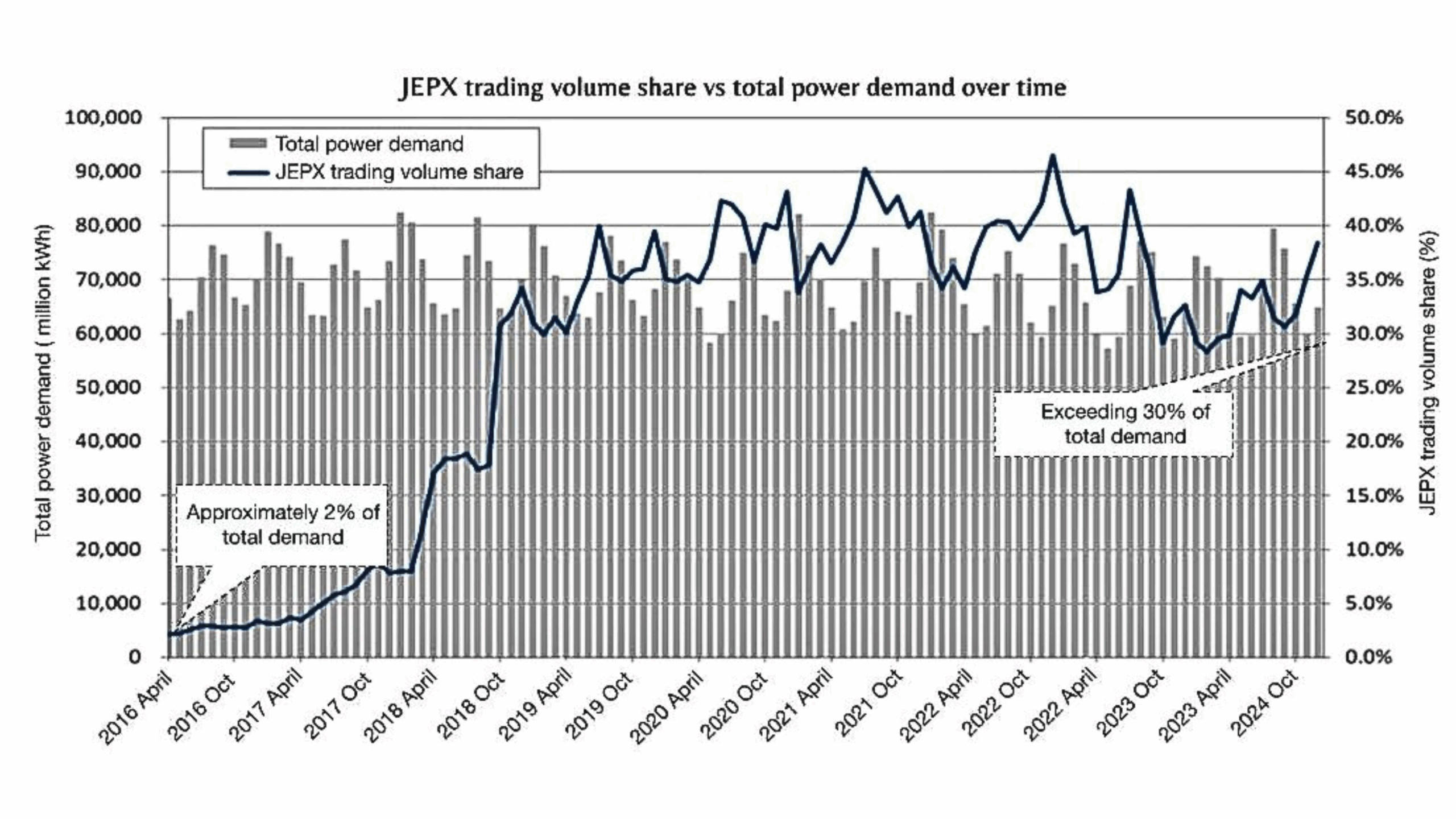

Japan’s current power procurement landscape is dominated by short-term spot market transactions, creating what METI identifies as problematic price volatility and revenue unpredictability for generators. The ministry’s solution is ambitious: mandate forward procurement while simultaneously creating new market infrastructure to support it.

The proposed framework requires retailers to secure both capacity (kW) and volume (kWh) well in advance, with compliance monitored through each retailer’s supply plan. The stakes are significant; failure to meet procurement requirements could result in retail license revocation, a penalty that underscores METI’s commitment to this structural reform.

To support this mandatory procurement, METI proposes establishing a “Mid-Long Term Market” (中長期取引市場) encompassing futures, forwards, OTC transactions, broker-mediated trades, and power purchase agreements (PPAs). This new market aims to establish Japan’s first comprehensive long-term electricity price index.

Market Dynamics and Trading Opportunities

For sophisticated traders, the proposed changes may present several opportunities:

Forward curve development: The mandate will likely establish Japan’s first robust forward curve extending three years ahead. Initially, wider long-term versus spot price spreads may emerge, creating arbitrage opportunities for traders who can effectively manage basis risk across time horizons.

Volatility trading: Generators with market power may strategically lock in low marginal cost assets for T-3 transactions while reserving high marginal cost generation for spot markets. This dynamic could boost spot market volatility, creating favorable conditions for battery energy storage systems (BESS) and other flexible assets that thrive on price volatility.

Bilateral contracts: The emphasis on revitalizing bilateral contracts opens opportunities for experienced traders to structure bespoke arrangements that meet retailers’ compliance needs while capturing value from market inefficiencies during the transition period.

New product innovation: METI’s consideration of non-specification of load types (base, middle, peak) suggests product standardization that could enhance liquidity while creating opportunities for load-following and shaped products that better match actual consumption patterns.

—

Strategic Implications for Market Entrants & Looking Ahead

Current industry opposition to the proposal in its existing form suggests that implementation delays and modifications are likely. This creates a strategic window for new entrants to establish market positions before the regulatory framework solidifies and compliance costs potentially increase.

For international traders considering Japanese market entry, the evolving regulatory landscape reinforces the importance of securing appropriate METI licenses now. The proposed framework may increase barriers for future entrants while potentially “grandfathering” existing participants under more favorable terms.

The anticipated creation of new trading platforms and mechanisms suggests opportunities for technology-forward traders to gain competitive advantages through early adoption and integration of new market infrastructure.

For international traders, the interconnection between licensing requirements, market participation rules, and compliance obligations creates a multi-dimensional challenge that extends beyond simple market analysis. The proposed changes amplify the importance of expert regulatory guidance, particularly for entities considering market entry or expansion strategies.

While industry opposition may modify or delay implementation, the proposal signals METI’s intent to structurally transform Japan’s power markets toward greater forward market participation. Traders who understand these regulatory dynamics and position accordingly may find significant opportunities as the framework develops.

The next phases of METI’s discussions will address critical implementation details including trading mechanisms, demand estimation methodologies, and assessment frameworks. These technical specifications will ultimately determine the practical opportunities and constraints facing market participants.

—-

Thank you for reading.

If you found this topic interesting, and would like to meet us in person to discuss these developments and learn more about our services, join us at Japan Power Week, taking place 20 – 23 October, 2025.

Shulman Advisory provides comprehensive regulatory guidance and strategic insights for international power traders seeking to navigate Japan’s complex and evolving electricity markets. Our deep understanding of METI’s regulatory processes and market dynamics enables clients to identify opportunities and mitigate risks in Japan’s rapidly changing power sector.