Publication date: Feb 16, 2024

The Japanese government is issuing Japan Climate Transition Bonds this month. The 10-year bond will go live on February 14, and the 5-year bond on the 27th. The sale is expected to raise JPY1.6 trillion, which will be used to implement the government’s Green Transformation (GX) policy.

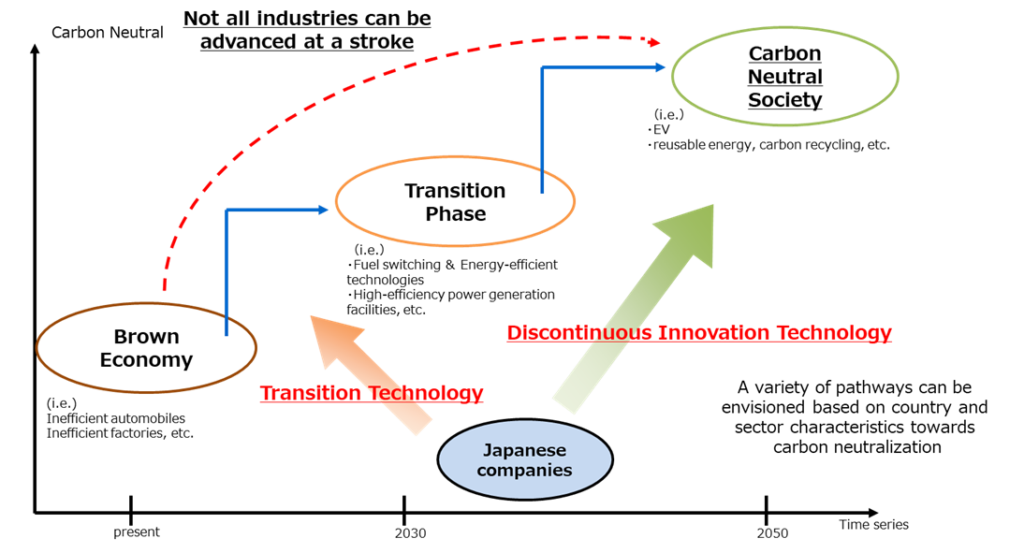

The government’s targets for support are high-emission companies participating in the GX League (a group of over 640 Japanese companies voluntarily committing to pursue carbon neutrality). These companies will use the proceeds from the bond to promote the research, development, and manufacturing of low carbon technologies in the #energy and industrial sectors.

According to the bond’s framework document, the government would prioritize projects that meet the following conditions:

- Projects that are too risky for the private sector alone to invest in.

- Projects that contribute to strengthening Japan’s industrial competitiveness, economic growth, and emissions reductions.

- Projects that fit well with regulatory measures that change investments and demand-side behavior.

- Projects that contribute to expanding domestic investment, including human capital development.

As the Nikkei reported on February 4, the government clarified which companies will receive these funds:

- Hydrogen steel production: JPY254 billion will be allocated to #hydrogen steel production by Nippon Steel, JFE Steel, and Kobe Steel.

- Next-generation semiconductors: JPY75 billion will be spent on next-generation semiconductors (to make the use of artificial intelligence more energy efficient) by NTT, Shinko Electric, Kioxia, and Micron Technology.

- Industrial furnaces: JPY32.5 billion will be used to support Chugai Ro, Sanken Sangyo, and Tokyo Gas to develop low-carbon industrial furnaces.

- Next-generation nuclear reactors: Mitsubishi Heavy Industries will be given JPY12.4 billion to research and develop next-generation nuclear reactors.

- Batteries: JPY331.6 billion will be spent on helping Honda, Toyota, Panasonic, and GX Yusa expand their battery manufacturing.

- Power semiconductors: Toshiba and ROHM will receive JPY152 billion to scale up their production of power semiconductor devices.

The Climate Transition Bond has been evaluated by two external certification agencies, both of which concluded that the policies financed by the bond align with the UN Paris Accord’s 1.5°C warming target. The bond will be redeemed from the revenue of the carbon pricing and emissions trading scheme that was announced last year.

Stay tuned for more updates from our end.

________________________________________________________________________________________