Publication date: May 20, 2025

Second Round of LTDA Sees Rising Interest From BESS Operators

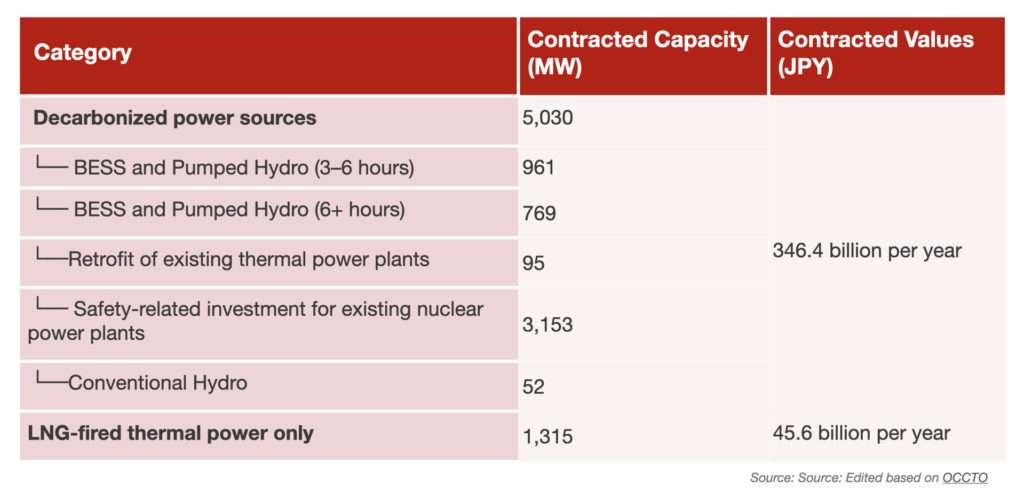

The Organization for Cross Regional Coordination of Transmission Operators (OCCTO) announced the results of the FY2024’s second round of the Long-term Decarbonization Auction (LTDA). The eligible power sources this time were largely divided into “decarbonized power sources” and “LNG-fired thermal power only.” The former had a contracted total volume of 5,030 MW—almost matching the bid capacity of 5,000 MW—with an annual contract value of JPY 346.4 billion. The latter had a contracted volume of 1,315 MW compared to the bid capacity of 2,243.68 MW, with an annual contract value of JPY 45.6 billion.

Among the “decarbonized power sources,” the category of “Battery Energy Storage System (BESS) and Pumped Hydro” was subdivided, for the first time, by operation duration: 3-6 hours and 6 hours or more. The contracted output was 961 MW for the former and 769 MW for the latter. Looking only at BESS, the total bid volume for both categories reached 6,956 MW, while the awarded volume was just 1,370 MW—a success rate of only 20%. According to market insiders, the high volume of BESS bids was because the fixed costs factored in during bidding are less likely to escalate in the future, making profits more predictable. The largest individual BESS project awarded was by Bison Energy at 130 MW, followed by Japan Energy Storage at 120 MW.

Second Round of LTDA Sees Rising Interest From BESS Operators

Nuclear Safety Investments and Future Outlook

In the auction, a category of “safety-related investment for existing nuclear power plants” was also included for the first time. The contracted volume was 3,153 MW with a success rate of 73%. Awarded projects included Japan Atomic Power Company’s Tokai Unit 2, Hokkaido EPCo’s Tomari Unit 3, and TEPCO Holdings’ Kashiwazaki-Kariwa Unit 6—indicating progress toward restarting these nuclear plants.

The schedule for the third round of LTDA has yet to be determined. However, some power producers are facing cash flow shortages and are requesting the introduction of advance payments for future capacity revenues, enabling investment recovery even before construction is completed.

___________________________________________________________________________________