Japan’s 2030 environmental goals and the preliminary energy mix proposal that came with them are pushing for an increase of solar PV generation to 15% of the nation’s power, versus 7% in the previous plan. In Japan, the bottleneck for developing mega-solar PV plants is securing the land. Developers have therefore been eyeing the agrivoltaic market as a substitute. The commissioning of solar PV plants on agricultural land is a sensitive topic in Japan. On the one hand, Japan has a low self-sufficiency rate for food production, and any policy that would decrease farmland yield is sure to be scrutinized by the government. On the other hand, agricultural land area has decreased by 28% since 1958, and agrivoltaic could bring an economical solution to revive some abandoned land. In this article, we review the development process and regulations of the Japanese agrivoltaic market and explore some recent case studies.

The Current State of Agrivoltaic in Japan

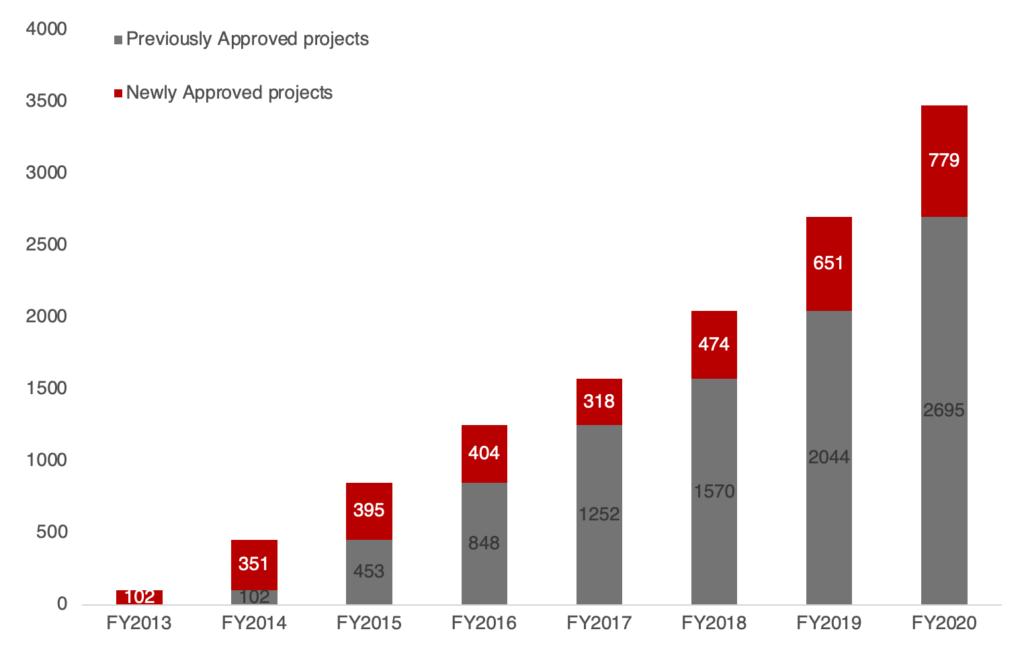

By the end of FY2019, there were 2,695 agrivoltaic projects, approximately 670MW, covering 742 hectares of agricultural land in Japan. This had increased to 3,474 projects on 872.7 hectares by FY2020. These projects have been commissioned under the feed-in-tariff program. The government budgeted a 1.4billion JPY to support agrivoltaic in FY2020. According to consultancy RTS, the market is expected to keep growing to 4GW of installed capacity by 2030. Many companies are developing projects and collaborating with universities on R&D. Among them are Chiba Ecological Energy, West Energy Solution and Looop. More Japanese corporations such as ENEOS and Updater (previously Minna Denryoku) have also made their interest in this market public.

Getting approval to develop an agrivoltaic plant is only half of the hurdle, as the authorization can be revoked during the plant’s lifetime. The land under an agrivoltaic plant must still be cultivated. Plant owners must submit their crop yields every year and every three years. The operations are reviewed, and approval to continue operating is delivered. Since 2018, after the regulations have been changed, some projects only require a review every ten years instead of every three years. The periodic review aims to verify that the production yield is at least 80% of the average yield in the area and is performed by the Ministry of Agriculture, Forestry and Fisheries (MAFF).

In April 2021, MAFF relaxed the 80% criteria for projects installed on degraded agricultural land. In this case, MAFF will only verify that the land is being cultivated but does not impose any yield requirement.

This is a risk that owners of other PV plants are not familiar with and can annihilate a project’s returns. Building a solid partnership with the person or company cultivating the land is essential to ensure that the yields are within the targets imposed by MAFF.

To develop an agrivoltaic plant, an application must be filed with the local agricultural affairs committee to convert the status of the targeted piece of land. Here too, the focus is on the impact of a solar PV installation on farming activities. The following data must be submitted during the application:

• Plan for agrivoltaic facility

• Plan for farming under solar panels

• Expectation of impact on farming with supporting data and written opinion from a specialist

• If the agrivoltaic facility owner and the farmer are not the same person, a document is required to certify that both parties agree that the installer must bear the removal costs at the end of the plant life

The applications can be submitted at any time and are usually reviewed within a month. 87.9% of 340 applications were approved in 2018 based on a survey of agricultural affairs committees.

For assets larger than 10MW, an environmental impact assessment is also necessary. MAFF also requires a study of water drainage for all the plants to ensure that no damage will occur to nearby agricultural water channels.

If the application process is not a major hurdle, the opposition of local communities is more likely to impair the development of projects. A survey of agricultural affairs committees in 2018 found that 18.1% of respondents thought that agrivoltaic farming would spoil the landscape. Local governments and farmers are also concerned that the development of agrivoltaic might cause the decline of agriculture and accelerate the collapse of rural communities. In the same survey, 58.8% of respondents answered that they did not think it possible to cultivate crops under solar panels properly, and 48% thought that agrivoltaic was unnecessary.

A recent case study in Omaesaki city, Shizuoka Prefecture, illustrates this opposition. 80% of the households in the area opposed a recent agrivoltaic project, and the city intends to enact an ordinance restricting solar PV installation. Like the recent development of mega-solar assets, it is now crucial for developers to convince local communities of the benefits of their projects.

Costs and Impact on Crop Yields

If agrivoltaic plants come with a higher EPC cost than standard PV plants due to the elevated position of the panels (some players mention a 50% increase in racking costs), their operation and maintenance costs can be substantially cheaper (some players say by up to a factor of eight) due to the maintenance of the land already performed for farming purposes.

The crops must meet a minimum yield and bring financial revenues close to their original value. It is also explicitly required that the agricultural land be restored to its initial form at the end of the plant’s life.

According to a MAFF study, close to 65% of agrivoltaic projects change the type of agriculture to meet the constraints imposed by the PV plant. The financial impact on the farming business can therefore be contained, and the feasibility of the projects comes down to the monetization of the solar asset. However, MAFF is worried that larger-scale development of agrivoltaic could impact the local markets for some crops.

Despite these factors, the major hurdle for the development at scale of agrivoltaic projects is likely to be similar to that for other PV plants: with the end of the feed-in-tariff, the monetization of the assets will require developers and asset owners to review and change their business model. PV plants below 50kW might qualify as “regional power sources” and receive a feed-in tariff, but bigger plants will have to be exposed to feed-in-premium and/or PPAs. Despite this, the agrivoltaic market will likely keep growing with the recent involvement of major Japanese corporations.